A billion dollars of trade in 1 photo (Update May 19, 2025)

Where does spending on imports go? And on tourism, consumer sentiment, and inflation...

While the U.S. and China recently paused most tariffs on May 12, the OOCL Violet arrived in Long Beach a few weeks earlier on April 25. With ~$564 million of Chinese goods on board, Bloomberg estimates the goods on board will be slapped with ~$417 million in tariffs.

A picture is worth a thousand words. One container ship, ~$1 billion dollars of trade.

Wild.

Designed by Apple in California, Assembled in China

Those famous words are sketched on the back of iPhones and MacBooks sold around the world.

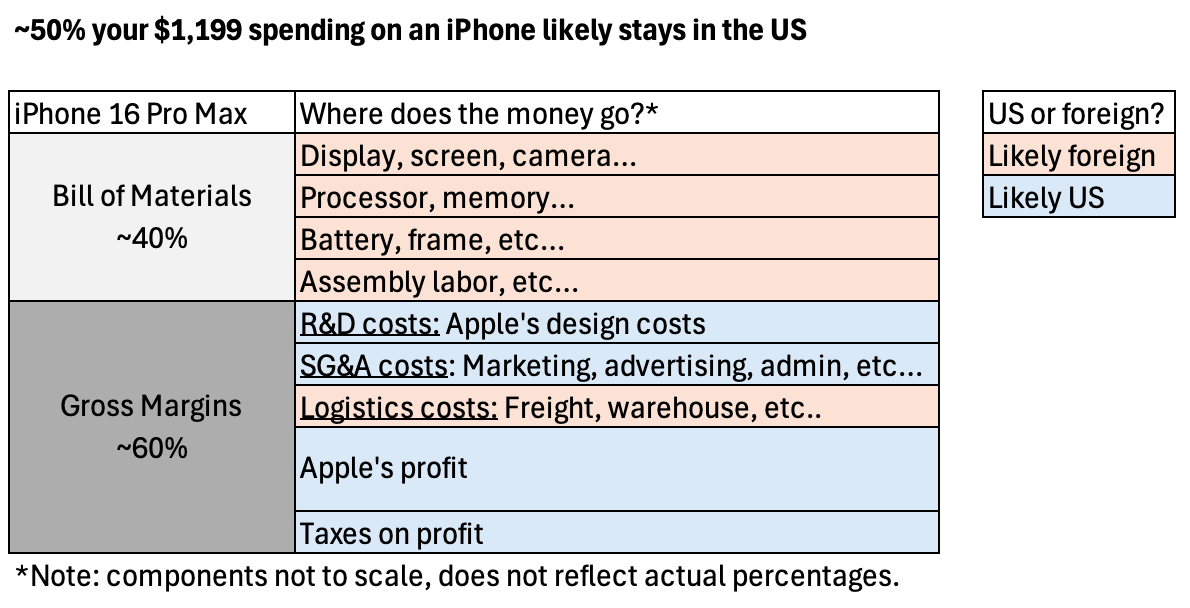

To explain the impact of imports on American businesses and consumers, it is helpful to go through an illustrative example of how spending on imported goods breaks down.

When you buy an iPhone (an imported product), where does your money go?

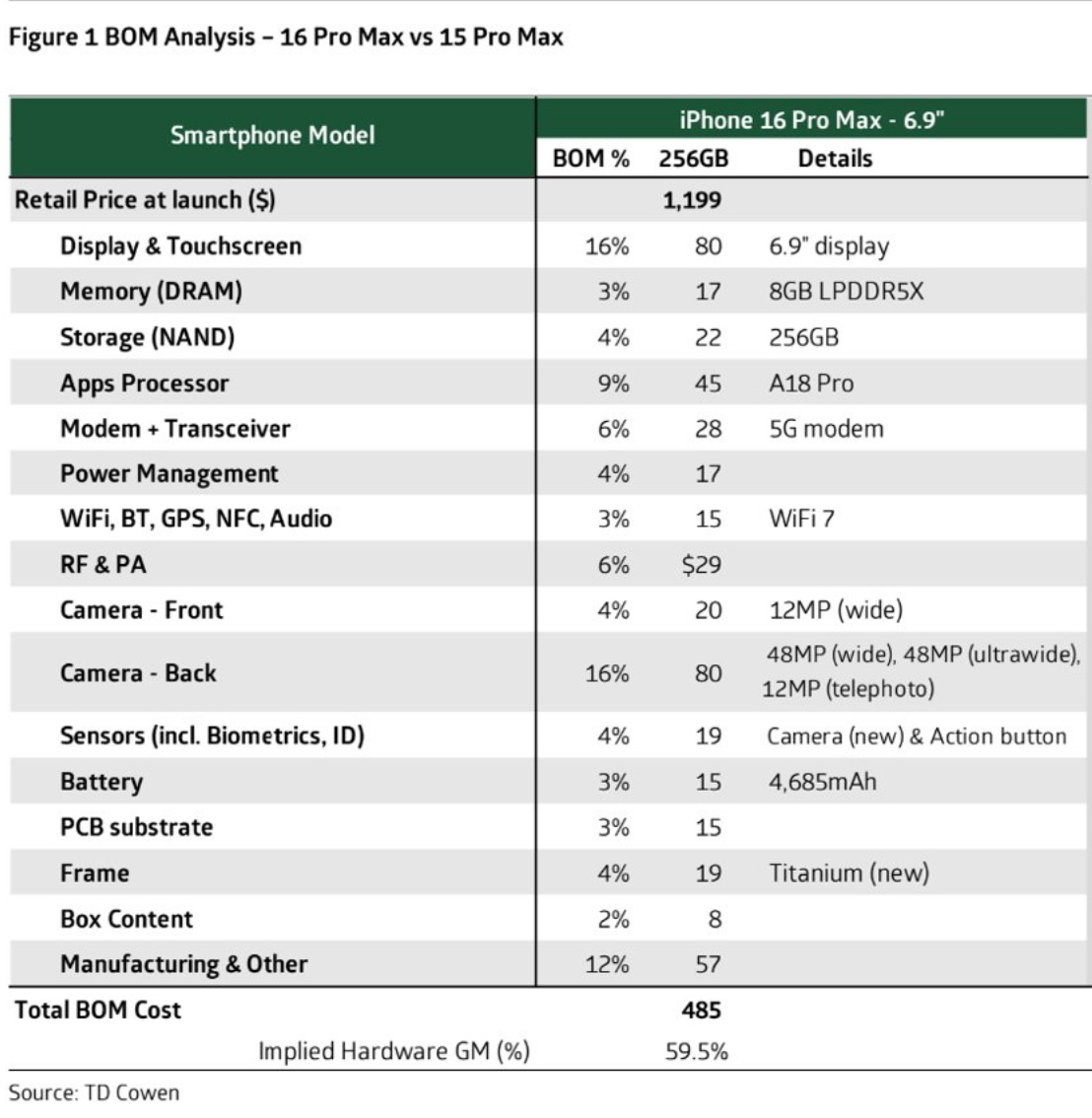

An iPhone 16 Pro Max retails for $1,199 in the U.S.

TD Cowen, an investment bank, estimates the phone has a ~$485 bill of materials (BOM) cost. Manufacturing and assembly costs about ~$57, which is mostly labor costs. The camera, screen, memory, frame, and other components cost about ~$438.

The BOM cost is the total price that Apple pays for the iPhone to be manufactured, and assembled, and made ready for shipping. This cost excludes any duties (tariffs), logistics (shipping), and other costs after the product is assembled. It also excludes any indirect costs of the phone, i.e. the costs for Apple to design and market the phone.

However, Apple does not get to keep the entire ~60% gross margins on the hardware.

To bring a new iPhone to the market, Apple had to:

design (R&D costs)

market (SG&A costs)

ship (logistics costs) the phone to the consumer

Apple’s profits are also taxed by various governments (which includes U.S. federal and state income tax).

Ultimately, if an U.S. consumer spends ~$1,200 on a new iPhone, ~$600 likely stays in the U.S. as opposed to going overseas.

~56% of spending for “Made in China” goods stay in the US

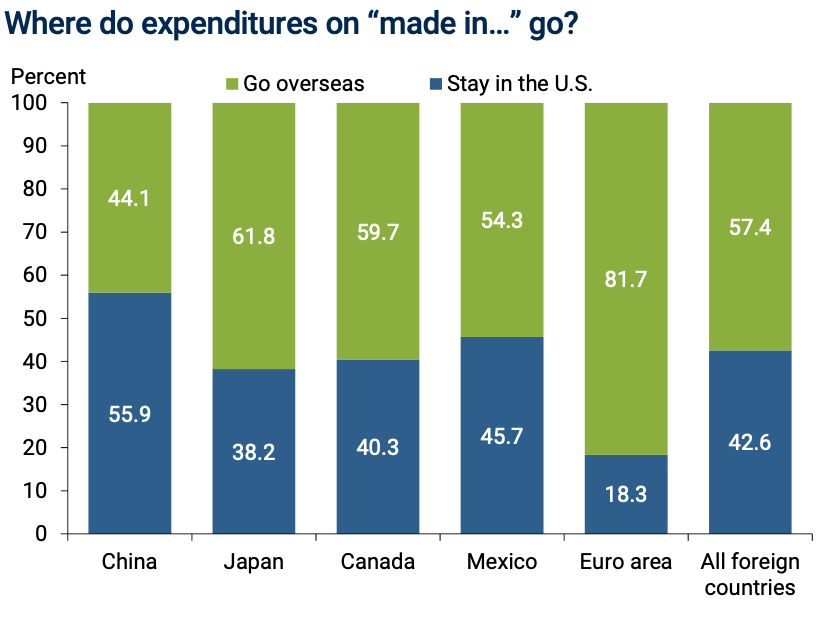

In 2019, the Federal Reserve Bank of San Francisco conducted a study on U.S. imports.

For every $100 spent on imports, $42.6 stays in the US.

For Chinese imports, the amount staying in the U.S. is higher. $55.9 dollars spent on $100 of Chinese imports remain in the US.

Buy the iPhone, please. When Apple profits, America profits.

The “Designed in California” portion of the engraving is certainly a critical aspect of the iPhone.

When you buy an iPhone, most of your money goes to U.S. businesses. So if you want to buy American, buy the iPhone.

The American brand: What happens when foreigners don’t visit?

In a previous issue, I mentioned how foreign tourism has dramatically declined since Trump’s attack on global trade.

Recently, the World Travel & Tourism Council (WTTC), a trade association, estimated the U.S. will lose ~$12.5 billion in direct foreign tourism spending in the US.

Not only that, Bloomberg reports, “Out of 184 global economies analyzed by WTTC in conjunction with Oxford Economics, it’s the only one projected to lose tourism dollars this year.”

The projection represents a ~6% year-over-year decline in direct tourism spending in the US.

A ~$50 billion trade: From deficit in “goods” to deficit in “goodwill”

The Bureau of Economic Analysis (the U.S. agency responsible for measuring the U.S. GDP) estimates that tourism represents about ~3% of the U.S. GDP. In 2024, nominal GDP for the U.S. was $29,184 billion.

Doing some rough math, the ~6% annual decline in tourism translates to a decline in GDP of about ~$53 billion. Keep in mind, the U.S.’s trade deficit with China is only ~$294 billion in 2024.

The U.S. may simply be trading its deficit in “goods” for a deficit in “goodwill”.

You can decide what is a good trade.

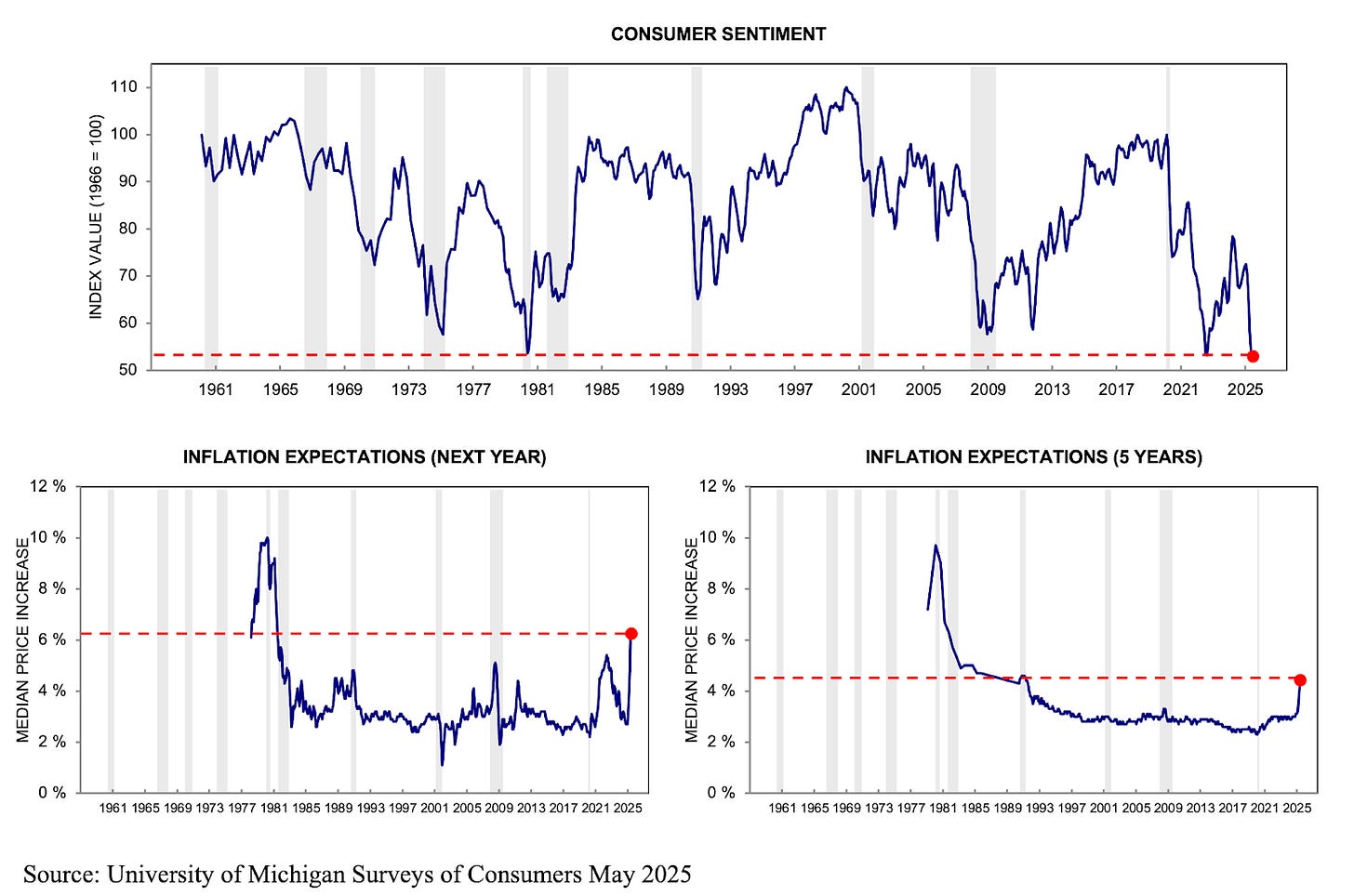

Expecting higher inflation, consumer sentiment sinks to near record low

Wow, U.S. consumers really are not optimistic about the future.

Inflation expectations continue to skyrocket, hitting levels unseen since the 1980’s.

Remember inflation rates and inflation expectations are very closely related, to the extent that it is almost a self-fulfilling prophecy.

Expecting higher inflation, workers bargain for higher wages. Sellers list their products and services with higher prices as a result, and consumers spend more today expecting items to cost more tomorrow.

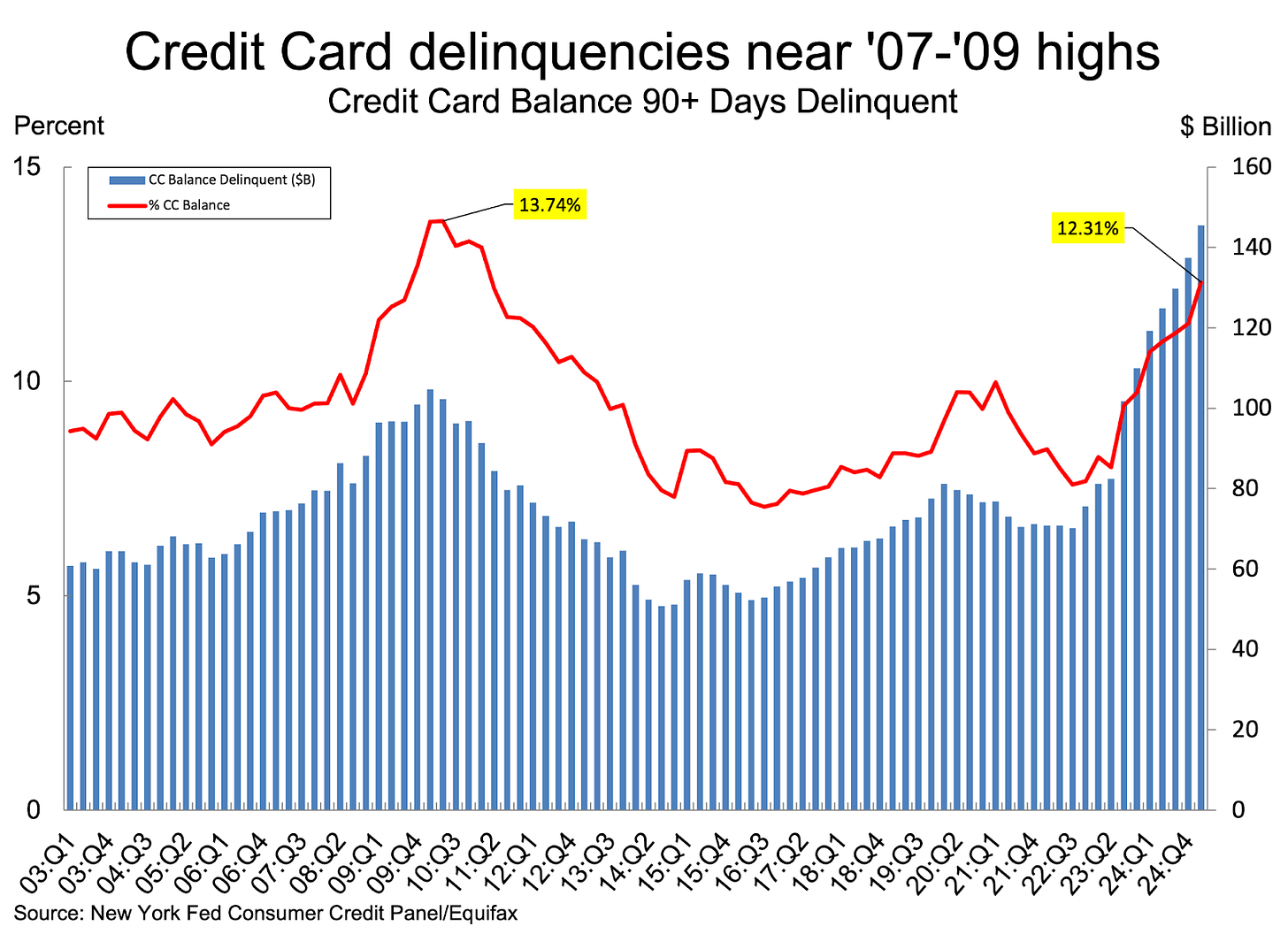

Early signs of worsening hard data on consumer credit

At the same time, in addition to soft data (as surveys are known), hard data is still mixed on the state of the economy.

At least for the portion of consumers that rely on revolving credit card debt (usually the consumer segments that are most disadvantaged), delinquencies continue to climb.

Credit card delinquencies do not reflect well on the state of overall consumer health, but often provide early signs of trouble ahead.

Walmart, world’s largest retailer, is increasing prices

In its latest earnings call on May 15, Walmart CFO said they have already started to pass on cost increases to consumers.

Despite the pause on U.S.-China tariffs, Walmart prices are expected to continue to increase through May and June. That is because a third of Walmart’s goods are still imported from abroad, and import tariffs are still ~13-15% on average.

From Bernstein and the Economist:

Before the recent trade truce with China, which has resulted in American tariffs being lowered to 30% for 90 days, Bernstein estimated that new import duties were on course to raise the cost of products sold at Walmart by an average of 5.2%. Suppliers, it reckoned, would absorb half of that, with the average sticker price in Walmart stores rising by 2.6% to make up the balance. Sales volumes would drop by 2% in response, giving revenue a net boost of around half a percent.

Thanks for reading. See ya next week.