The invaluable American brand (Update May 26, 2025)

Monday, May 26, 2025

Good morning.

At the beginning of May, I wrote about a few structural issues that the U.S. will face as it navigates past “Liberation Day”:

The permanent damage to the American brand

Dual-sided (supply and demand) supply chain shocks caused by tariff uncertainty

Acceleration of shift in global security and geopolitical center of gravity

Fiscal discipline and accelerating U.S. government debt burden

Here is a quick update on the American brand, while we’ll slowly cover developments in the other points later in June.

The invaluable American brand

A concept that may be obvious to most financially minded folks: the value of a company’s brand is often the company’s largest asset.

Yet, this “intangible” asset value is often not formally included in modern financial accounting and reporting.

You will not find any “dollar” value on these companies' balance sheets for the brand value of Apple, Tesla, Coke Cola, and other iconic American brands.

“I think I’ve done enough”: Brand value destruction at Tesla

The most obvious example of self-inflicted brand value destruction is Tesla. As the leader of DOGE, Elon Musk did not do Tesla any favors by appearing in the White House’s cabinet room and oval office.

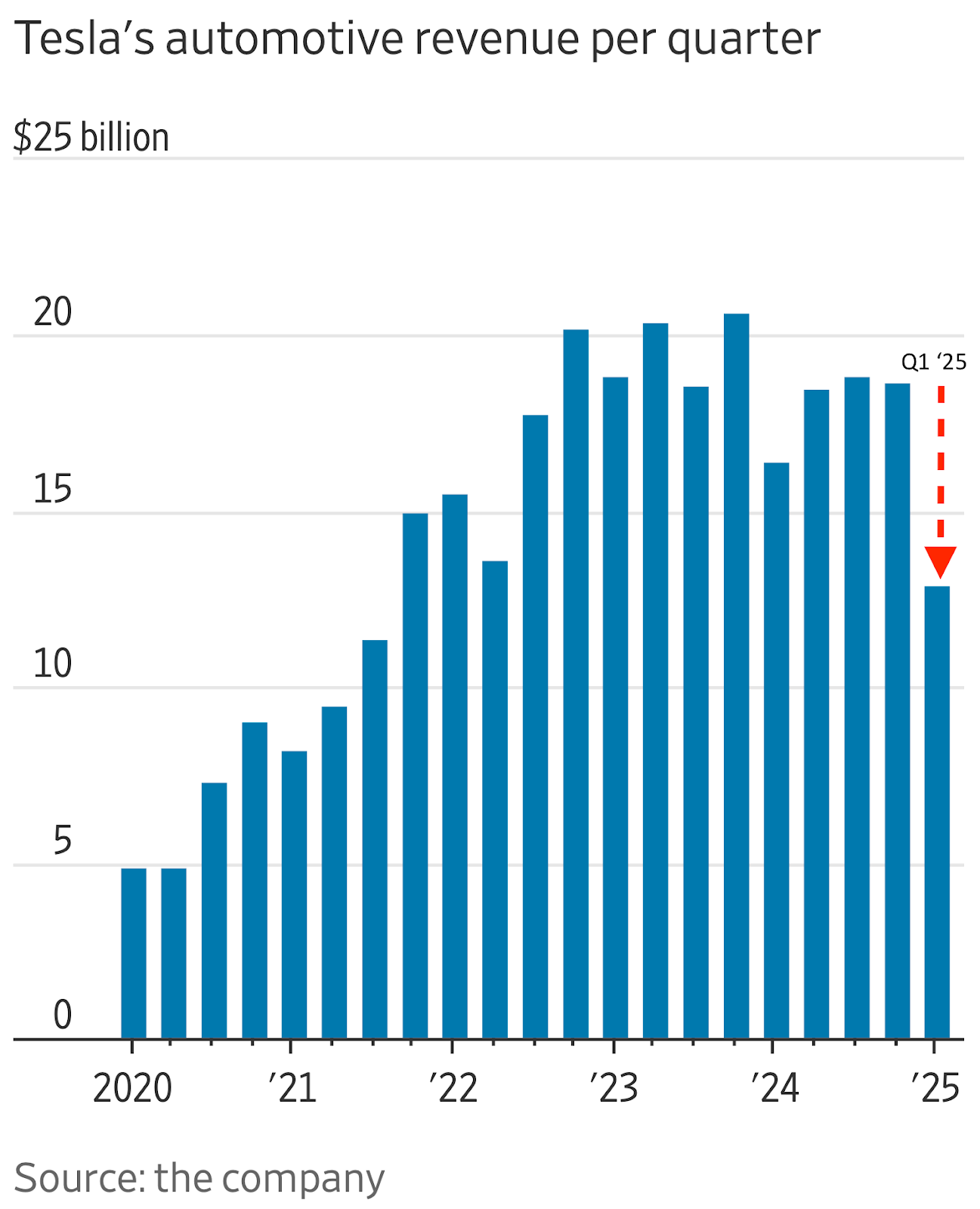

In Tesla’s Q1 ‘25 earnings, Tesla reported car deliveries fell ~13%, and also missed Wall St consensus deliveries by ~53k cars.

It was Tesla’s worst quarter since 2022, giving back almost 4 years of progress.

Earlier this week, Mr. Musk has finally come to his own conclusion that, “I think I’ve done enough.” He was referring to his political contributions and activities.

Well, unfortunately, what’s done is done. There is unlikely to be an easy do-over.

In a few quarter’s time, EV market share figures in the U.S. will show how much permanent damage has been done. Anecdotally, I think Rivian trucks and SUVs have taken over San Francisco’s streets.

China has overtaken the U.S. in favorability around the world

China is now more popular than the U.S.

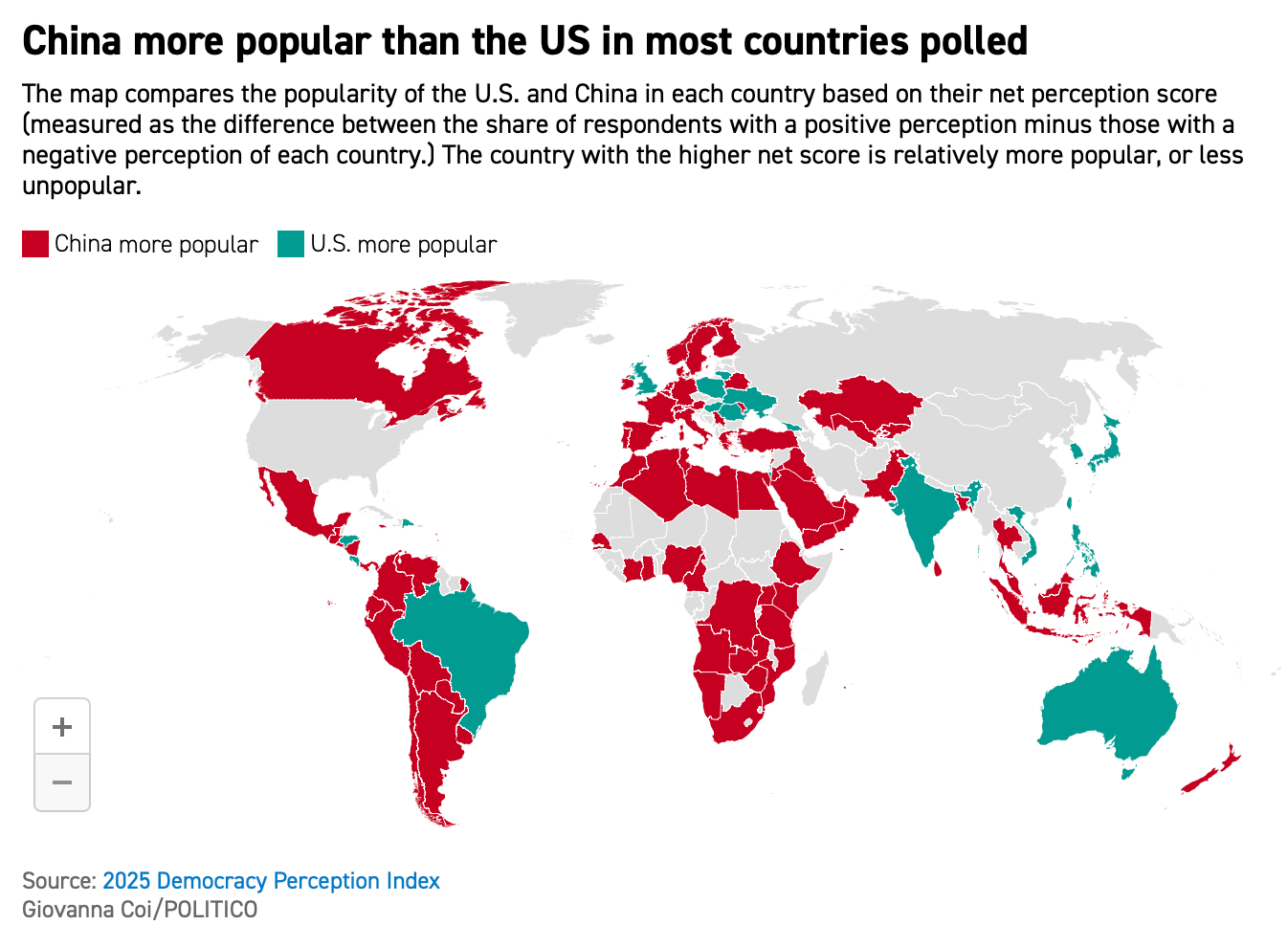

According to two independent studies, the 2025 Democratic Perception Index and the Morning Consult’s daily tracker both show a broad change in popular sentiment away from the United States.

The shift in sentiment is broad and global. As you can see in the map below, China has grown more popular than the U.S. in many democratic and affluent European nations (Scandinavia, France, Germany, Spain, etc..).

Not only, the shift is also apparent in America’s closest neighbors: Canada and Mexico.

The permanence of the White House’s trade actions have started to take shape.

At last week’s G7 meeting of finance ministers and central bankers in Canada, European Central Bank President Christine Lagarde said:

"International trade will never be the same again."

“What sounded like a complete reshuffling of the cards as of April 2nd [of] this year has also launched a complete review of relationships, of trust, of diversification of sources and destination of both products and services”

Canada hosts the G7 meetings this year. Mark Carney, Canada’s newly elected leader, also gave a likewise sobering speech:

“Our old relationship with the United States, a relationship based on steadily increasing integration, is over. The system of open global trade anchored by the United States – a system that Canada has relied on since the second world war, a system that while not perfect has helped deliver prosperity for a country for decades – is over.”

Well, that sucks.

Harvard University: Attack on America’s thought and academic leadership

In light of Trump’s attempt to cut off international students from Harvard University, the Editorial Board of the Wall Street Journal wrote a rebuke of Trump’s attack on Harvard.

“This will be terribly damaging to America’s ability to attract talented young people who bring their enterprise and intellectual capital to the U.S. Non-citizens accounted for more than half of doctoral degrees in AI-related fields in 2022. Many have gone to work at U.S. companies like Nvidia or started their own.

The National Foundation for American Policy finds that “immigrants have founded or cofounded nearly two-thirds (65% or 28 of 43) of the top AI companies in the United States, and 70% of full-time graduate students in fields related to artificial intelligence are international students.” Immigrants have also started more than half of America’s privately-held startups valued at $1 billion or more.

Even if it’s modified, Ms. Noem’s order will echo around the world as a signal that the U.S. is no longer open to educate the world’s brightest young people. Foreign students will get the message and take their talents elsewhere. China’s politburo must be laughing at their good luck that their main adversary is hamstringing itself—first with tariffs that make its firms less competitive, and now with an assault on immigrant talent.”

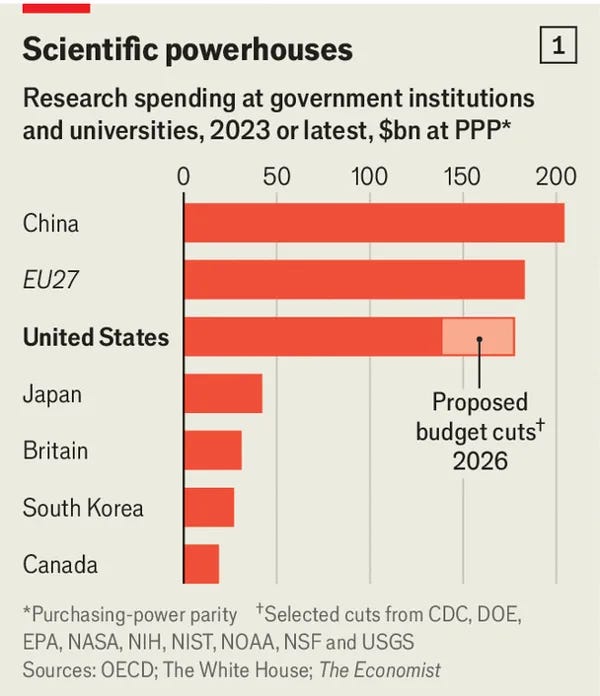

China already spends more government funding on research than the E.U. and the U.S.

At a moment in time when the U.S. should be doubling down on science and research, the U.S. is deciding to cede another position to China.

China is not wasting any time.

Peking University and Tsinghua University (both top universities in China) are already closing deals with top scientists from Europe and the U.S.

New AI and science labs with guaranteed funding will attract unnerved scientists attempting to clear the grey “funding” cloud on their lifelong career.

The TACO theory?

The growing complacency in the U.S. equity markets (as markets rebounded very quickly from its April lows) suggests there is a growing Wall Street consensus on the TACO theory: Trump Always Chickens Out.

If you believe most of this will be backpedaled and trade dynamics will only be marginally higher than January 2025, then you probably believe a recession is unlikely this year.

But I do not buy this theory. There is an extraordinary flight to quality assets.

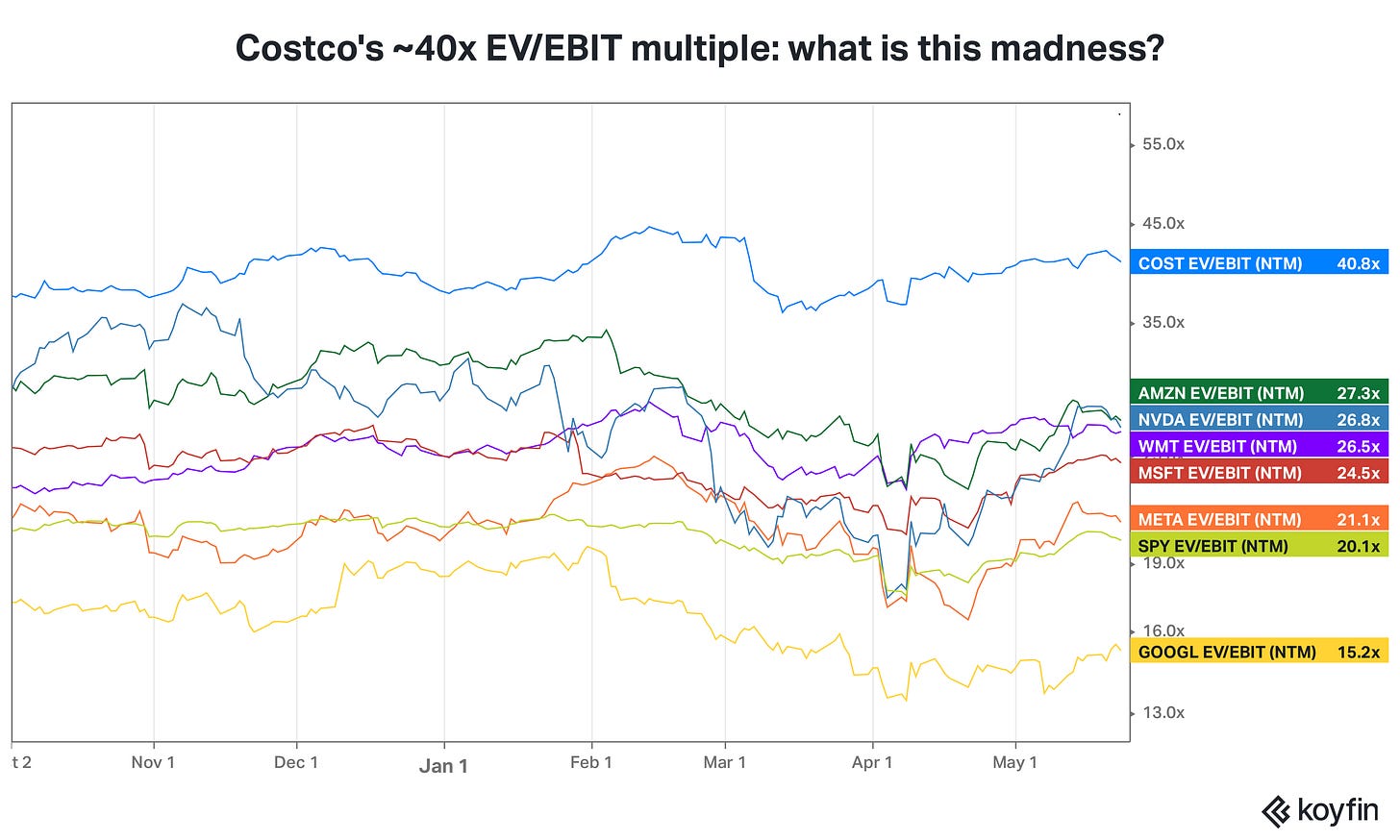

Costco’s current EV/EBIT forward multiple is ~40x, while Walmart has a ~27x multiple in line with the likes of Nvidia and Microsoft.

This tells me that the Street has very little confidence in earnings more than a few quarters ahead. But because of Costco and Walmart’s fortress non-cyclical business in retail, they are happy to give them less of a discount in future value. Their retail positions give them tremendous pricing power to outperform rivals in stagflation scenarios.

Add to that, last Monday, Jaime Dimon gave his annual Q&A at JPMorgan’s investor day. and he said:

I am not a buyer of credit today. I think credit today is a bad risk. I think that people who haven't been through major downturns are missing the point about what can happen in credit.

When the world’s largest lender is leaning towards less lending, I say that is a bad omen.

See ya next week.