Berkshire: Warren Buffett can still organize a surprise

The end of an era: 60 years of intelligent investing

Warren Buffett represents everything that is good about American capitalism and America itself—investing in the growth of our nation and its businesses with integrity, optimism and common sense. – Jamie Dimon

At Berkshire’s 60th annual shareholder’s meeting in Omaha, Nebraska, Warren Buffett held his last question and answer session as the CEO of Berkshire Hathaway. In the last 5 minutes of the shorter-than-usual 4 hour session, Buffett sprang a surprise to the world.

Greg Abel will become the CEO of Berkshire Hathaway by year’s end.

Berkshire shareholders will know, this is hardly a surprise. In 2021, Charlie Munger let slip that Abel will be the successor-in-waiting.

“Greg will keep the culture,” Munger said in response to a question about how to manage Berkshire’s growing complexity as a decentralized conglomerate.

GOAT

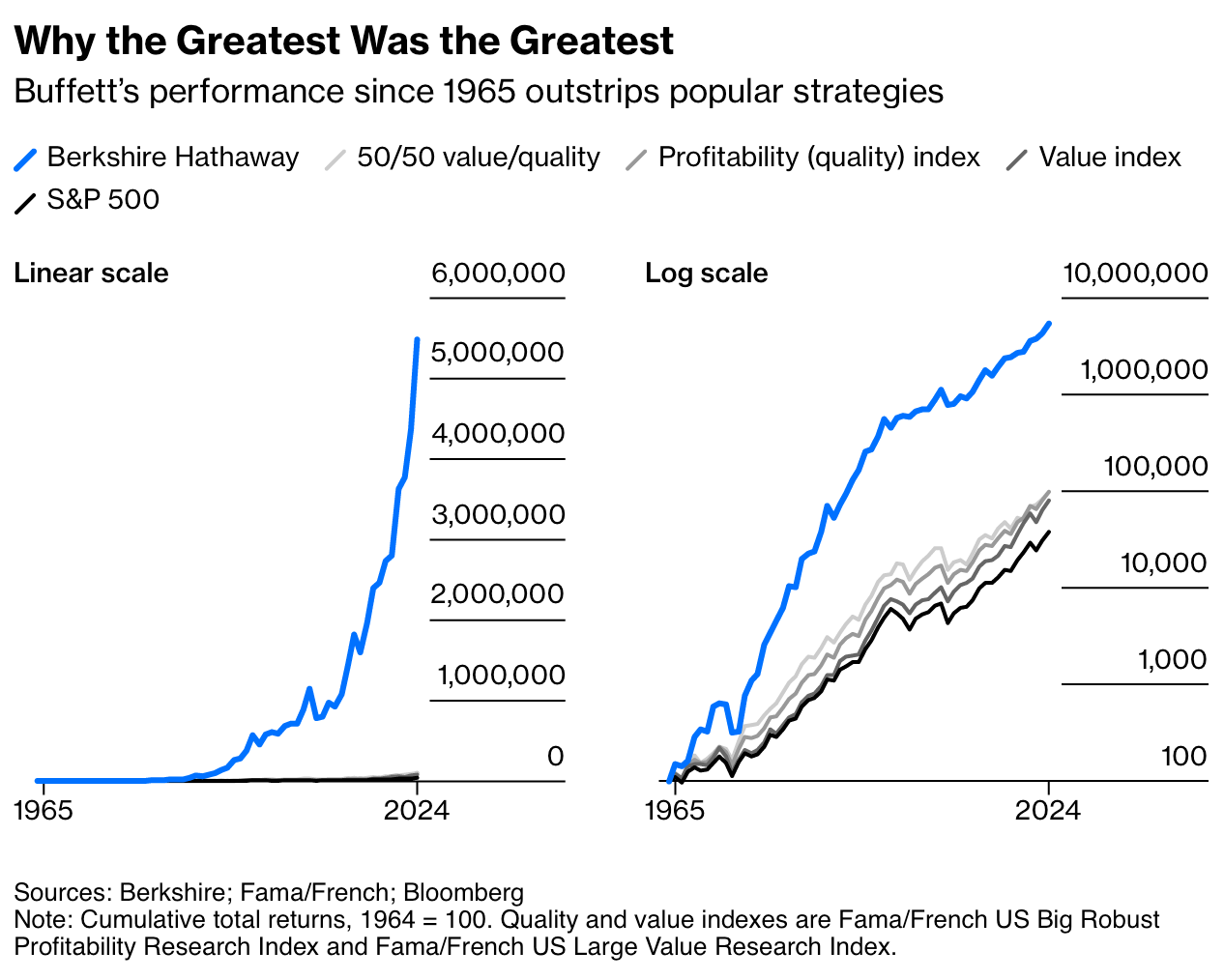

Many have written about Buffett’s legacy, and Munger’s.

The success of Warren Buffett’s $1.1 trillion empire is such that its scale overwhelms the S&P 500 return in a line chart, you can barely see the line.

New coach, new season

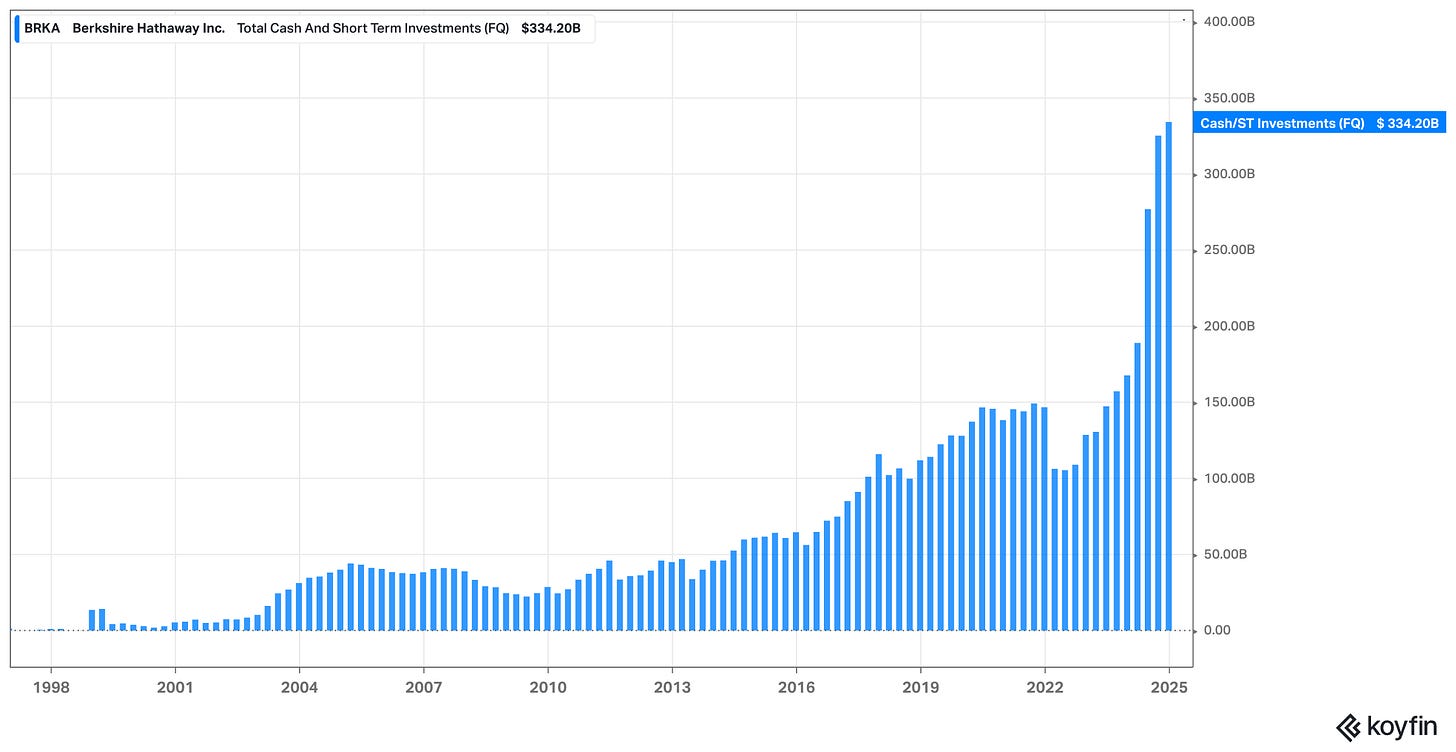

With ~$340 billion1 in cash built up, Berkshire has a war chest ready for this new era.

Target, Nike’s, Lowe’s, CVS, and United Airlines.

Berkshire’s war chest can afford to buy all 5 of these companies at today’s prices.

It is safe to say this chapter of American capitalism has come to a close, and there will never be another one like it. In finance, size is returns’ worst enemy.

Here are 4 hours of his final Q&A session as CEO

To the Oracle of Omaha, let’s raise a Coke and have a McDonald’s burger in his honor.